Clergy Exempt From Social Security

Its here for you when a serious health condition prevents you from working or when you need time to care for a family member bond with a new child or spend time with a family member preparing for military service overseas. Effective January 1 2003 for clergy members employed by the.

Should Ministers Opt Out Of Social Security Youtube

From the Federal tab uncheck the FUTA Social Security or medicare boxes as appropriate.

Clergy exempt from social security. Some churches do establish a taxable social security allowance increasing the cash compensation of the pastor to help defray the extra cost of the self-employment tax. Under the Self-Employment Con-tributions Act SECA the self-employed per-son pays all the taxes. Note that under Section 107 of.

Clergy Tax Return Preparation Guide for 2020 Returns and the 2021 Federal. Therefore the minister will have to pay tax to the IRS in quarterly installments throughout the year. Social security and Medicare taxes are collected under one of two systems.

If your state has an SUI surcharge or tagalong. But clergy are both exempt from federal income tax withholding and considered self-employed for Social Security tax purposes. Paid Family and Medical Leave is a new benefit for Washington workers.

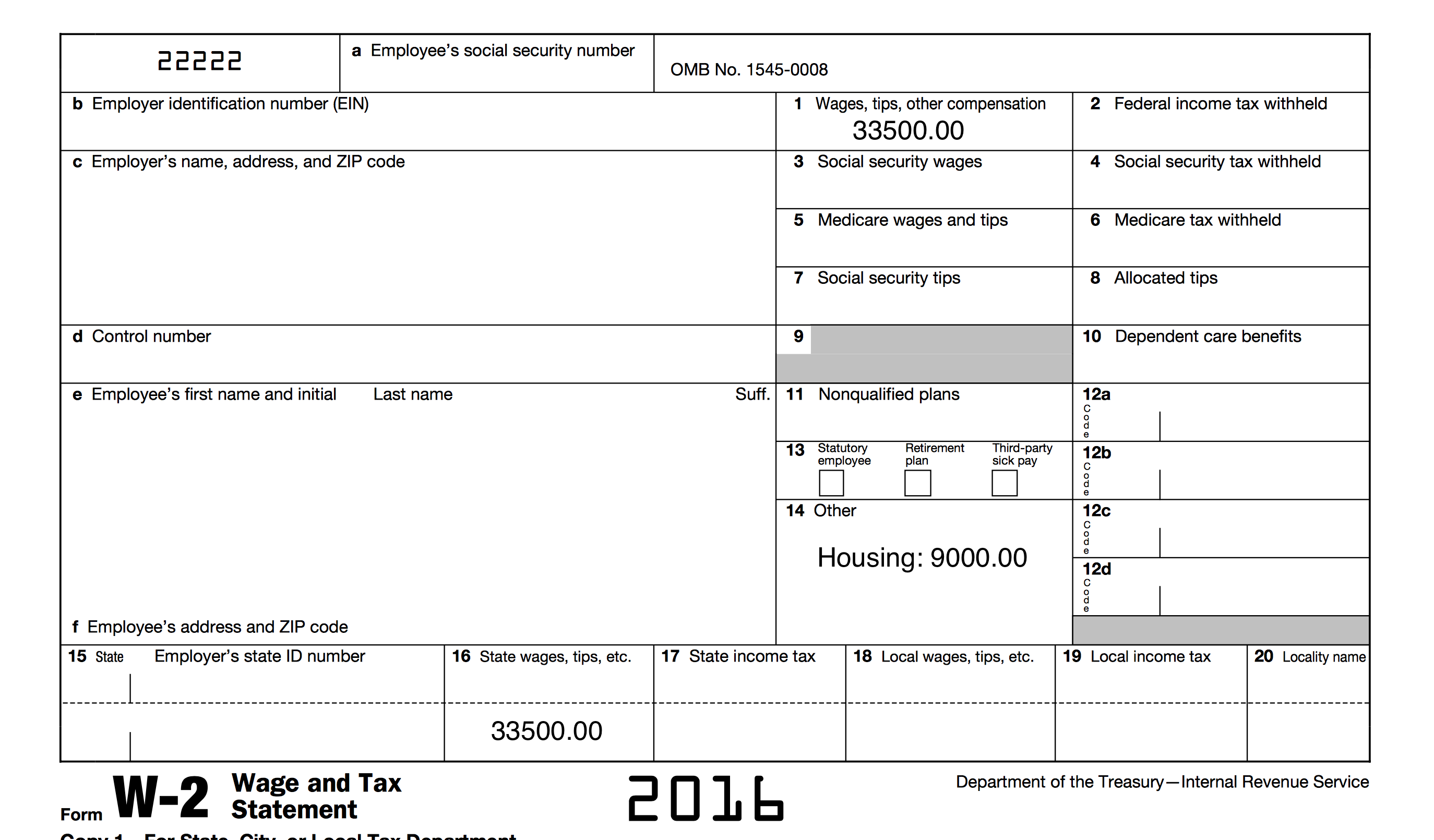

Unless a church includes it in an informational section on Form W-2 the IRS and the Social Security Administration SSA are only made aware of the housing allowance when a minister files. From the State tab uncheck the SUI box and any other state tax boxes as appropriate. The CLGY clergy screen is only for those taxpayers coded as P in the Special tax treatment box on the W2 screen.

If the minister has self-employment income related to a religious activity enter business code 813000 on screen C. Under the Federal Insur-ance Contributions Act FICA the employee and the employer each pay half of the social se-curity and Medicare. This is an excerpt from my book The Pastors Wallet Complete Guide to the Clergy Housing Allowance.

How is the housing allowance reported for social security purposes. Pub 538 Accounting Periods and Methods. Publication 517 covers the collection of social security and Medicare taxes from members of the clergy and religious workers including how members of the clergy can apply for exemption from self-employment tax.

If a treaty does not specifcally exempt income from state income tax California requires the reporting of. Ministers have a unique tax status. This means a church normally wont withhold income tax and never should withhold Social Security tax for clergy.

While it is true that the clergy housing is exempt from federal income tax but it is not exempt from Self-Employment tax. It is reported by the pastor on Schedule SE of Form 1040 line 2 together with salary. Pub 517 Social Security and Other Information for Members of the Clergy and Religious Workers.

This publication contains information for ministers members of a religious order Christian Science practitioners and readers religious workers church employees and. Pub 557 Tax-Exempt Status for Your Organization. Pub 571 Tax-Sheltered Annuity Programs for Employees of Public Schools and Certain Tax-Exempt Organizations.

The church is not required to report the housing allowance to the IRS. Ministers are exempt from FICA and pay SE tax unless they have an IRS-approved exemption as described below. For tax purposes a minister is a person who is a duly ordained commissioned or licensed minister of a church This includes Rabbis and other ordained clergy.

Social Security Benefts 13 Other IncomeLoss 13 Adjustments to Income 15 Itemized Deductions 16 ONLINE SERVICES. And thereby exempt the eligible amount from federal income tax. Security tax and Medicare tax.

Pub 526 Charitable Contribution. From the Other tab select your. You will still enter your clergy housing using the methods that were previously mentioned and then it should not be reported for federal tax purposes but you will still need to pay Self-Employment FICA taxes.

For purposes of Social Security and Medicare taxes ministers are considered to be self-employed and these taxes are not withheld from their pay. Individuals attending conferences and meetings are considered business visitors and are exempt from the requirement for a work permit. Social Security taxes due from March 27 2020 through December 31 2020 can be deferred until 2021 and 2022.

An individual who preaches oversees religious services or provides spiritual counselling as a profession may work in Canada without a work permit. From the Payroll Info tab select Taxes.

Do Pastors Pay Social Security And Medicare The Pastor S Wallet

47 Printable Employee Information Forms Personnel Information Sheets Templates Form Incident Report Form

Can Pastors Opt Back Into Social Security The Pastor S Wallet

How Does The Minister S Housing Allowance Affect Social Security Retirement Benefits The Pastor S Wallet

Social Security Exemption Archives The Pastor S Wallet

Starting A Home Church Social Security

Churches Can Pay Social Security Allowance To Clergy Staff

Can You Use Irs Form 2031 To Opt Back Into Social Security The Pastor S Wallet

Belum ada Komentar untuk "Clergy Exempt From Social Security"

Posting Komentar